TranspArEEnS

mainstreaming Transparent Assessment of Energy efficiency in Environmental social governance ratingS

About

Improving access to long-term finance for Energy Efficiency (EE) projects is key to achieve the EU2030 targets and aligning the Covid-19 recovery to the European Green Deal. However, the lack of standardized disclosure of EE investments limits firms’ access to EE financing. Further, poor understanding of EE information in ESG ratings increases the risk of greenwashing, thus preventing a smooth development of the sustainable finance market.

TranspArEEnS, Horizon 2020 project, addresses these barriers by mainstreaming a quali-quantitative framework for standardized collection and analysis of firms’ EE and ESG information and the development of a standardized EE-ESG rating. This serves as an EE-ESG filter to inform investment and financial policy decisions with regard to portfolios’ alignment to sustainability. A unique added value of this project is to cover non-listed Small and Medium Enterprises, meeting an important market need. TranspArEEnS’ EE-ESG rating will be tested in pilot case studies and capacity building sessions with leading representatives of the financial industry and supervisors.

TranspArEEnS is linked to the Energy Efficient Mortgage Initiative. It builds on and complements the outputs of three previous related EU-funded projects:

- the Energy efficient Mortgages Action Plan (EeMAP);

- he Energy efficiency Data Protocol and Portal (EeDaPP);

- the Energy efficient Mortgage Market Implementation Plan (EeMMIP)

Project

TranspArEEnS objective is to enhance standardized disclosure of EE and ESG information at firm level, to foster access to long term financing (e.g. via securitization) and better risk assessment, while taming the risk of greenwashing.

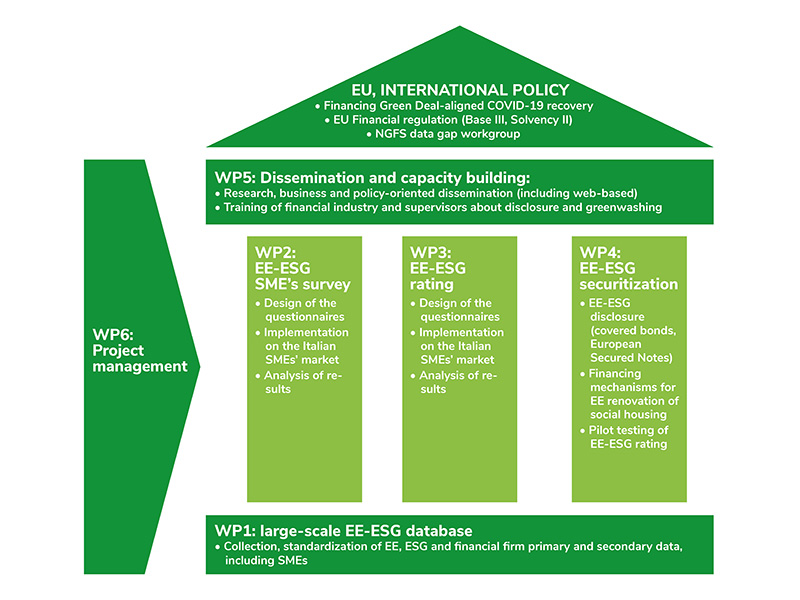

TranspArEEnS will achieve its goal by means of five measurable objectives that foresee the collaboration of project partners from academia, financial policy and industry:

- develop a standardized large-scale EE-ESG database;

- develop a standardized EE-ESG SMEs (Small and Medium Enterprises) survey;

- develop standardized EE-ESG rating;

- support long term EE-securitization;

- dissemination and capacity building.

Structure of the project

The project runs for thirty months and is organized in the following steps:

- Identification of the main ESG drivers of listed firms’ performance considering 600 indicators for the E, S and G dimensions and using data providers such as Bloomberg and Thomson Reuters/DataStream.

- Construction of a large-scale database at firm level that combines and standardizes information related to EE, financial and E/S/G performance of listed firms.

- Construction of a similar database focusing on the EE dimension to detect its role in ESG’s E scores in the context of SMEs.

- Design of a survey among a large sample of Italian SMEs in order to collect information to evaluate SME’s EE investments and performance in different sectors (buildings, industry, transport, etc.).

- Distribution and collection of the questionnaire through different channels.

- Interpretation of results of the survey, that will allow to collect for the first time firm-based information about one of the three main pillars of the EU Taxonomy, i.e. the identification of SMEs’ activities that substantially contribute to one of the six environmental objectives.

- Development of an EE-ESG credit rating built on ArtificiaI Intelligence, Machine Learning and Big Data techniques integrated by the qualitative information from the SMEs survey and the database.

- Market surveys and experts’ interviews to understand the market needs for EE-securitization.

- Development and test of financial structures to support the issuance of debt securities for EE-based financial products focusing on two types of securitized financial instruments, namely Covered Bonds and European Secured Notes (ESN).

- Knowledge co-production workshops for analysis of barriers/opportunities for long term financing of EE-investments in the building sector and the introduction of EE-ESG considerations into monetary policy and financial regulation.

- Capacity building initiatives and pilot testing of the new EE-ESG ratings for SMEs in collaboration with selected banks.

Partners

Coordinator:

Ca’ Foscari University of Venice

Ca’ Foscari University of Venice is a public University with a national and international outstanding reputation for academic excellence in both teaching and research. The Department of Economics develops knowledge and understanding of economic phenomena dealing with the complexity of global market scenarios and exploring related social, juridical, ethical and environmental implications.

A new research Center in Economic and Risk Analytics for Public Policies (VERA Center) has been created and it focuses on big data applied to social welfare and wellbeing, risk analytics and evaluation of public policies. The Department is involved in several European projects in the field of sustainable finance, Energy Efficiency and ESG criteria: EIBURS-ESG-Credit.eu, EeMMIP- Energy efficient Mortgage Market Implementation Plan; EeDaPP - Energy efficiency Data Protocol and Portal; EeMAP - Energy efficiency Mortgages Action Plan.

Project partners:

CRIF Spa

CRIF is a global company specialising in credit bureau and business information, outsourcing and processing services, and advanced solutions for credit and open banking. Established in 1988 in Bologna (Italy), CRIF operates over four continents and currently is the leader in continental Europe in the field of banking credit information and one of the main operators on a global level in the field of integrated services for business & commercial information and credit & marketing management.

Moreover, CRIF is included in the prestigious IDC FinTech Rankings Top 100, a ranking of the leading global technology solution providers to the financial services industry, and in 2019 completed its coverage as an AISP in 31 European countries where the revised Payment Services Directive is applicable. Today over 10,500 banks and financial institutions, 1,000 insurance companies, 82,000 business clients and 1,000,000 consumers use CRIF services in 50 countries on a daily basis.

Covered Bond & Mortgage Council - CBMC

The Covered Bond & Mortgage Council (hereafter called the Council) is an international non-profit association under Belgian Law. The objective of the Council is to represent the interests of stakeholders in the mortgage credit and covered bond industry along its whole value chain, namely covering mortgage credit origination and servicing (represented by the European Mortgage Federation – EMF) and funding (represented by the European Covered Bond Council – ECBC) at both European and international levels.

Established in 1967, the European Mortgage Federation is the voice of the European mortgage industry, providing data and information on European mortgage markets, which were worth €8.15 trillion at the end of 2020. In 2004 the EMF founded the European Covered Bond Council, a platform that brings together covered bond market participants including issuers, analysts, investment bankers, rating agencies and a wide range of interested stakeholders. ECBC members represent over 95% of covered bonds outstanding, which were worth almost €2.9 trillion at the end of 2020. To achieve its goal(s), the Council undertakes to:

- Study measures that could be adopted at European and international levels in order to create a positive environment for mortgage credit lending and funding, and to disseminate this information for the benefit of its members and other stakeholders.

- Advise EU Institutions and other relevant authorities on all questions of interest to mortgage credit lenders, in the areas of both mortgage credit origination and funding.

- Act as a global platform for knowledge sharing and exchange of best practice and as a catalyst for market-led initiatives which add value to the market, the economy and society in general through innovation, quality and transparency, for example the Covered Bond Label, the Energy Efficient Mortgages Initiative and the Energy Efficient Mortgage Label.

MODEFINANCE Srl

MODEFINANCE is a native Fintech company specialized in companies’ and banks’ creditworthiness assessment, developing Artificial Intelligence solutions for credit risk analysis and management. Thanks to the MORE proprietary methodology, modefinance is able to evaluate any company, regardless of sector, size or country: as a Fintech Credit Rating Agency (CRA) registered at a European level, the ratings issued have legal value and can be used for regulatory purposes.

With a tailor-made, cloud-based and API approach, modefinance solutions allow users to easily access a wide range of financial risk analysis tools, to automate current procedures. modefinance supports financial services, banks and businesses in the daily management of exposure risk by providing high quality, transparent and reliable evaluations worldwide.

Leibniz Institute SAFE

The Leibniz Institute SAFE is a research institute dedicated to research and research-based policy advice in all areas of finance, with a special focus on Europe. Its research program includes six research areas: Financial Intermediation, Financial Markets, Household Finance, Money & Finance, Macro & Finance, and Law & Finance. With its international and interdisciplinary group of researchers, SAFE combines the methodological and professional competences for a broad range of topics related to financial markets and financial institutions.

This also includes topics of sustainable finance, climate change and energy efficiency mortgages. A unique feature of SAFE is its Data Center, which provides data access to all the major financial and economic data providers (FactSet, Datastream, Bloomberg and CRSP/Compustat) and creates new European datasets. The SAFE Policy Center distributes and disseminates research findings to the policymakers and regulators. The main goal is to provide theory- and evidence-based policy advice on fundamental political challenges

News and events

4/04/2024 - The results of TranspArEEnS project on a sample of more than 600 enterprises of Veneto Region

One year after the invitation of Unioncamere Veneto to participate to the European project TranspArEEnS in order to obtain a ESG rating for SMEs, the 4 of April (at 10 AM) will be organized, at the Chamber of Commerce of Treviso - Belluno, the presentation of the results on a sample of 600 enterprises from Veneto Region, which together generate a turnover of over 13 billion euro. The focus will be to share a quantitative and qualitative overview of the Veneto Region economic fabric related to the three dimensions of sustainability.

The event will provide also an overview on the knowledge and results of the European TranspArEEnS projects after three years of activities. It will be based on a dialogue in the TALK&IN format with PWC, KPMG, National Bank of Italy, the Confederation of Craft Trades, OCSE, European Mortgage Federation and the Order of Chartered Accountants and Auditors of Treviso.

Finally, during the events a TranspArEEnS ESG Reward will be released to 7 companies with ESG reporting success stories.

Participation is open contacting info@transpareens.eu.

22-23/09/2023 - CREDIT 2023: TranspArEEnS session on ESG Disclosure

A session dedicated to the TranspArEEnS topics and themes has been organised in the framework of the 23rd CREDIT Conference 2023 “Social, sovereign and geopolitical risks”, held in Venice, Palazzo Franchetti, the 22 and 23 of September 2023. CREDIT conference will bring together academics, practitioners and PhD students working in various areas of financial and socio-economic risk with the aim of creating a unique opportunity for participants to discuss research progress and policy as well as industry-relevant insights and directions for future research. ESG Disclosure is the title of the TranspArEEnS session, focused on the results of the TranspArEEnS ESG survey on SMEs.

5/06/2023 - New collaboration between CNA-Veneto and TranspArEEnS research team

The National Confederation of Craft - Veneto [ITA] will be supported by the tools and results of Transpareens project. The project will provide an ESG rating to measure the environmental, social and governance factors in order to facilitate SMEs access to sustainable finance.

23/05/2023 - Microenterprises and sustainability

The event, organized by the C4S - Center for Sustainability in the framework of the ASviS’ seventh Sustainable Development Festival, will take place the 23 of May in Treviso (16:30-17:30).

A dialogue with microenterprises and entrepreneurs from the Veneto region on Environmental, Social and Governance Reporting. The event will be the opportunity to present the Transpareens project and the ESG rating.

Sustainable Development Festival 2023 [ITA]

18/05/2023 - Confindustria Veneto Est Sustainability Week

TranspArEEns will be present at the Sustainability Week , the initiative organized by Confindustria Veneto Est to promote the culture of sustainability among SMEs. The project session on "Measuring and demonstrating Environmental, Social and Governance (ESG) sustainability" will be held the 18 of May (14:30-16:00) and will be the opportunity to present the first results of project activities.

7/03/2023 - Webinar "Measuring the ESG of SMEs through the TranspArEEnS project"

Unioncamere Veneto in cooperation with the Department of Economics of Ca'Foscari University organised a webinar focused on ESG and SMEs. The event was the occasion to present the ESG questionnaire offered free of charge by the TranspArEEnS project for assessing the Environmental, Social and Governance performance of SMEs.

More than 2000 SMEs have already joined the TranspArEEnS survey filling in the questionnaire in the Synesgy platform.

14/02/2022- TranspArEEnS at the EEMI Trento Bauhaus Week

TranspArEEns takes part to the Trento EEMI Bauhaus Week from February 13 to 16, 2023. "Combining smart digital & sustainable solutions to change the market paradigm” is the title of the event organized by the Energy Efficiency Mortgage Initiative (EEMI). This is the first in a series of market events intended to launch a new movement in the design, scale-up and roll-out of home ecosystems globally through the exchange of ideas, knowledge and best practice between financial actors, SMEs, start-ups, architects, scientists and academics, local authorities.

Monica Billio, coordinator of TranspArEEns project, attended the EEMI Academy Training Session on the second day, February 14, 2023, with a talk on "TranspArEEnsS: ESG ratings, the SMEs perspective".

More information: https://energyefficientmortgages.eu/eemi-trento-bauhaus/

23/11/2022 - TranspArEEns at the LIFE IS ENERGY Webinar

TranspArEEns has been invited to the webinar LIFE IS ENERGY: coordination and support actions for the “Transition to clean energy” on 23 November 2022.

“LIFE is Energy” is one of the 4 webinars organized by the National Contact Point LIFE in the framework of the initiatives to celebrate the 30th anniversary of the LIFE Program in Italy. 4 webinars dedicated to the 4 Life sub programmes: Nature and Biodiversity, Circular Economy and Quality of Life, Climate change mitigation and adaptation, Clean Energy Transition.

TranspArEEns is one of the three projects funded in the previous Horizon 2020 invited in the webinar dedicated to the Clean Energy Transition: SUPER-I, ICEE and TranspArEEns.

More information: website of the Ministry of the Environment [ITA]

22-23/09/2022 - Credit 2022. Long run risks

Venice

The Conference, organised under the auspices of the Department of Economics and VERA - Venice centre in Economic and Risk Analytics for public policies (Ca’ Foscari University of Venice), ABI - Italian Banking Association, AIAF - Associazione Italiana per l'Analisi Finanziaria and AIFIRM - Associazione Italiana Financial Industry Risk Managers, brings together academics, practitioners and PhD students working in various areas of financial and credit risk.

The theme of this year’s conference brings the attention on long run risks, whose notion is multifaceted, but whose impact is becoming more and more evident and is receiving attention both at political and regulatory level.

The European TranspArEEnS project enters phase 3

TranspArEEns is a 30-month EU-funded project that aims to develop a qualitative-quantitative framework for the standardised collection and analysis of EE (energy efficiency) and ESG (Environmental Social Governance) information of small and medium-sized enterprises and deliver a standardised EE-ESG rating in accordance with the recommendations and benchmarks provided at European level by the EU Technical Expert Group on Sustainable Finance (TEG).

TranspArEEnS Kick off meeting

Online event, 23 June 2022

The TranspArEEns Kick Off meeting took place on 23 June. The project led by Ca’ Foscari University of Venice and bringing together CRIF S.p.A, the EMF-ECBC, the Leibniz Institute for Financial Research SAFE and Modefinance srl, will establish a quali-quantitative framework, building on a large-base database model, to collect information about Energy Efficiency and the ESG performance of not only listed but importantly also non-listed firms, introducing a standardised EE-ESG rating model and thus meeting an important market need.

Presentation

TranspArEEnS project presented at the “Eccellenze del Nord-Est symposium” – the performance of north east enterprises

Treviso, 16 March 2022

The Order of Chartered Accountants and Accounting Experts of Treviso organized the annual symposium “Eccellenze del Nord Est” for presenting the analysis of the annual performance of enterprises in the Nort-East Regions (Veneto, Trentino Alto Adige and Friuli Venezia Giulia). Focus of the 2022 Conference the competitiveness of North East enterprises and the ESG factors .

Professor Michele Costola – Ca’ Foscari University of Venice – Department of Economics, will presented the TranspArEEns project and its implications for SMEs.

Presentation

|

|

Press release | 789 KB |

|

|

"Il Gazzettino di Treviso" 17/03/2022 [ITA] | 774 KB |

Compound risk: climate, disaster, finance, pandemic

Venice, 23-24 September 2021

The Conference, organised under the auspices of the Department of Economics and VERA - Venice centre in Economic and Risk Analytics for public policies (Ca’ Foscari University of Venice), ABI - Italian Banking Association, AIAF - Associazione Italiana per l'Analisi Finanziaria and the Joint Research Center, European Commission (Ispra, Italy), brings together academics, practitioners and PhD students working in various areas of financial and credit risk.

The theme of this year’s conference is the relation between financial risk on the one hand and pandemic, climate and disaster risk, on the other hand, with particular attention to the possible compounding of different sources of risk.

Outcomes

WP1 - Large scale EE-ESG database

The WP developed a large-scale database at firm level that combines and standardize information related to Energy Efficiency (EE), financial and E/S/G performance of both listed firms and SMEs.

WP2 - Standardized EE-ESG SMEs’ survey

The WP designed and conducted a survey among a large number of SMEs in Italy in order to collect information and to evaluate SME’s performance and EE investment in different sectors.

|

|

D. 2.1 - Report on standardized and replicable framework for SMEs’ EE-ESG questionnaire | 2 MB |

|

|

D. 2.2 - Report on questionnaires’ results | 2 MB |

WP3 - Standardised EE-ESG rating

WP3 developed a methodological framework of EE-ESG evaluations for SMEs. The new EE-ESG rating for SMEs has been integrated into a demo platform.

WP4 - Long term financing instruments for the “green recovery”

The WP analysed the key opportunities/barriers to enhance EE relevant standardised disclosure of ESG products. The WP focused on covered bonds and European Secured Notes.

WP5 - Dissemination and capacity building

The WP has three main objectives:

- to carry out the dissemination and communication of project results,

- to strengthen the network of stakeholders around the project consortium,

- to support by means of capacity building the operationalization of the project’s results into financial industry and policy practices.

Focus ESG

Focus ESG is the new communication format of Italpress developed in cooperation with the Department of Economics of Ca' Foscari University. A regular appointment dedicated to sustainable finance and ESG topics.

- Focus ESG 1 - The gender pay gap situation [ITA]

- Focus ESG 2 - The value of transparency [ITA]

- Focus ESG 3 - Green mortgages [ITA]

- Focus ESG 4 - The rising demand of ESG experts and practitioners [ITA]

- Focus ESG 5 - Cars price increasing [ITA]

- Focus ESG 6 - What is an ESG Rating? [ITA]

- Focus ESG 7 - ESG rating and the Italian banks [ITA]

- Focus ESG 8 - Why is everyone talking about ESG [ITA]

- Focus ESG 10 - The importance of ESG for Italian and European SMEs? [ITA]

- Focus ESG 12 - The first results of the TranspArEEnS Project [ITA]

- Focus ESG 13 - the debt capacity, the digital euro and cryptocurrencies [ITA]

- Focus ESG 16 - Transparency is strategic for SMEs [ITA]

- FOCUS ESG 18 - ESG Macrotrends 2024 [ITA]